Before you begin recording your Shopify gift card sales and redemptions, be sure to watch the video I created that shows you step-by-step how to do your monthly Shopify bookkeeping. The method I describe in this post is based on the method I demonstrated in the overview video. You can watch the first video HERE.

This post contains affiliate links. For more information, please see my disclosures.

More...

Getting Started with Shopify Finances Summary

Now, let’s get started. In Shopify, you’ll select Analytics, then Reports, scroll down to Finances Summary, and then scroll down to Gift Card Liabilities.

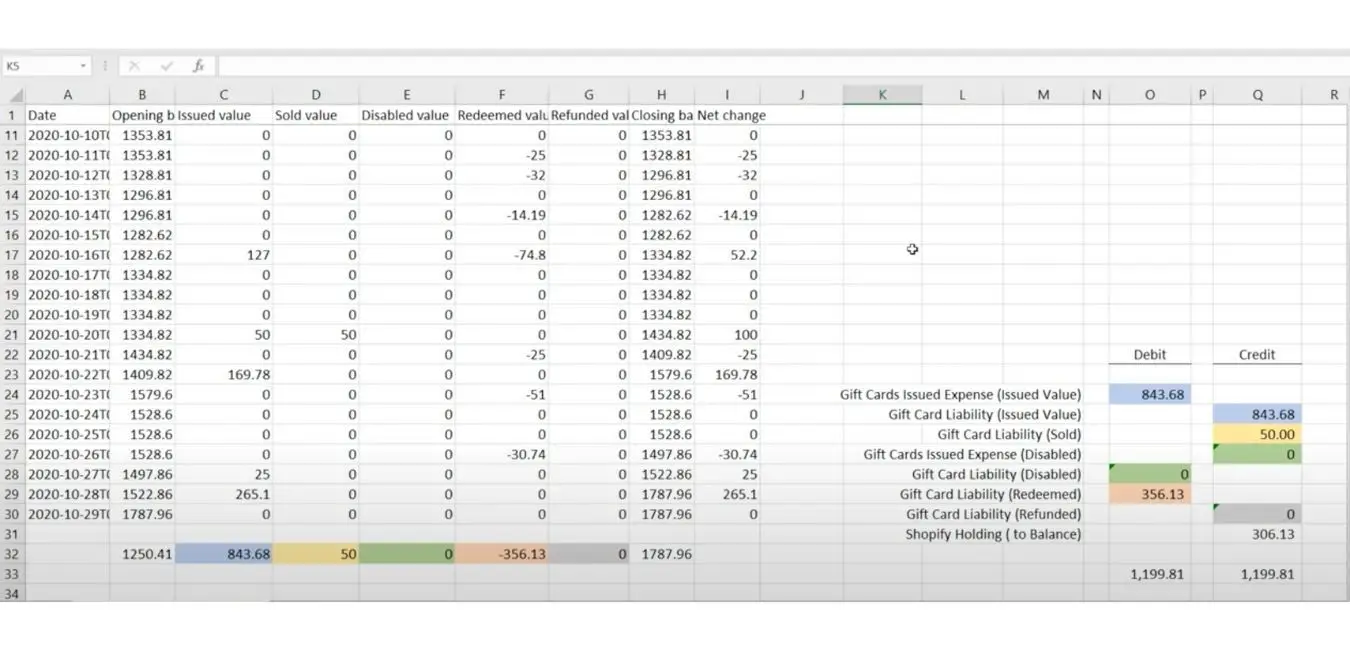

Here you’ll pull up a report that outlines the different ways gift card funds have impacted your revenue for the month. Since this report doesn’t have totals, you’ll need to export it to a spreadsheet so you can easily calculate the sum of each column.

As a quick overview, the main amounts you need to know are the gifts cards in and gift cards out. You’ll need to create two accounts in QuickBooks Online Simple Start. The first account, Gift cards issued, is an expense account. The second account, Gift card liability, is a current liabilities account.Breaking Down the Shopify Gift Card Numbers

Now let’s break down the columns in the Shopify report.

The first column is Issued Value and represents gift card amounts given to people that they haven’t paid for. For example, when you give a gift card as a prize. In essence, you’re incurring an expense.

For any gift card amounts issued, you’re going to Debit the Gift Cards Issued Expense, but you’re also going to Credit that same amount to the Gift Card Liability account. You’re increasing the amount of gift card dollars you have to fulfill at a later date.

Heading to the next column, Sold Value is when you’ve received cash for a gift card you’ve issued. You’re increasing your future gift card liability, so we’re going to Credit Gift Card Liability.

The Disabled column is for gift cards you issued that are no longer valid (e.g., there was an expiration date). In this case, we’re going to do the reverse of the Issued Value column. You’ll Credit the Gift Card Issued Expense and Debit the Gift Card Liability.

Next, we’ll address the Redeemed column. This accounts for gift cards that were used to buy products. This reduces the amount of our gift card liability, so will Debit Gift Card Liability for that amount.

In the refunded column, you’ll see the amount that represents people who purchased something with a gift card and then returned the item. This is like a sold transaction because you’re increasing the amount of the liability owed when you refund them their gift card value. So we will Credit Gift Card Liability.

At the end, the difference between your gift card Debits and Credits will go to Shopify holding. It can be a debit or a credit depending on what is needed to balance the entry. (In accounting, to post a journal entry, the debits and credit must be equal.)

You’ll notice that I used the gift card liability account over and over on this spreadsheet. This makes it easier to keep track of what’s happening with each column and allows you to match up the numbers before you go to the next step.

Making the Journal Entry

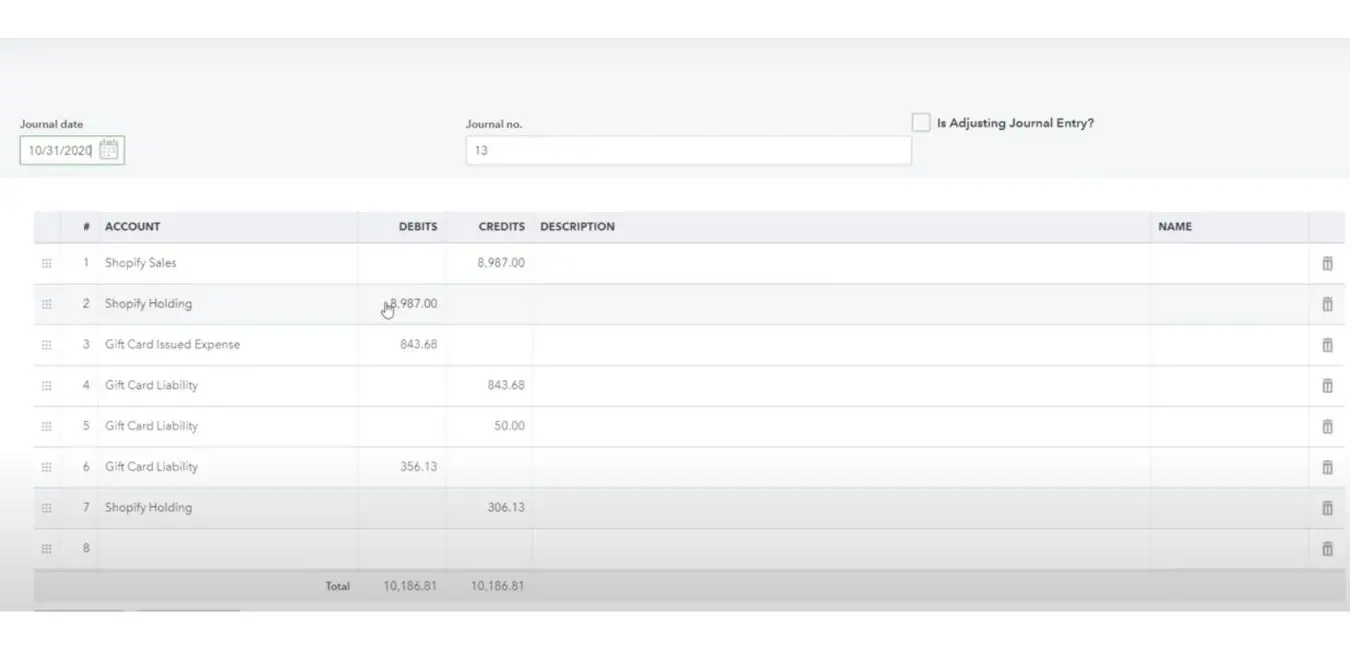

Now we’ll move over to QBO to set up the journal entry.

The first step is to enter the date of the journal entry. If you are following my full Shopify method, this date will be the last day of the month. The first two lines represent the Shopify entry I would have already done before. Now I’ll enter the other numbers we calculated on our spreadsheet. Again, the difference to balance the entry is applied to the Shopify Holding account. After you’ve created the entry, be sure to save it.

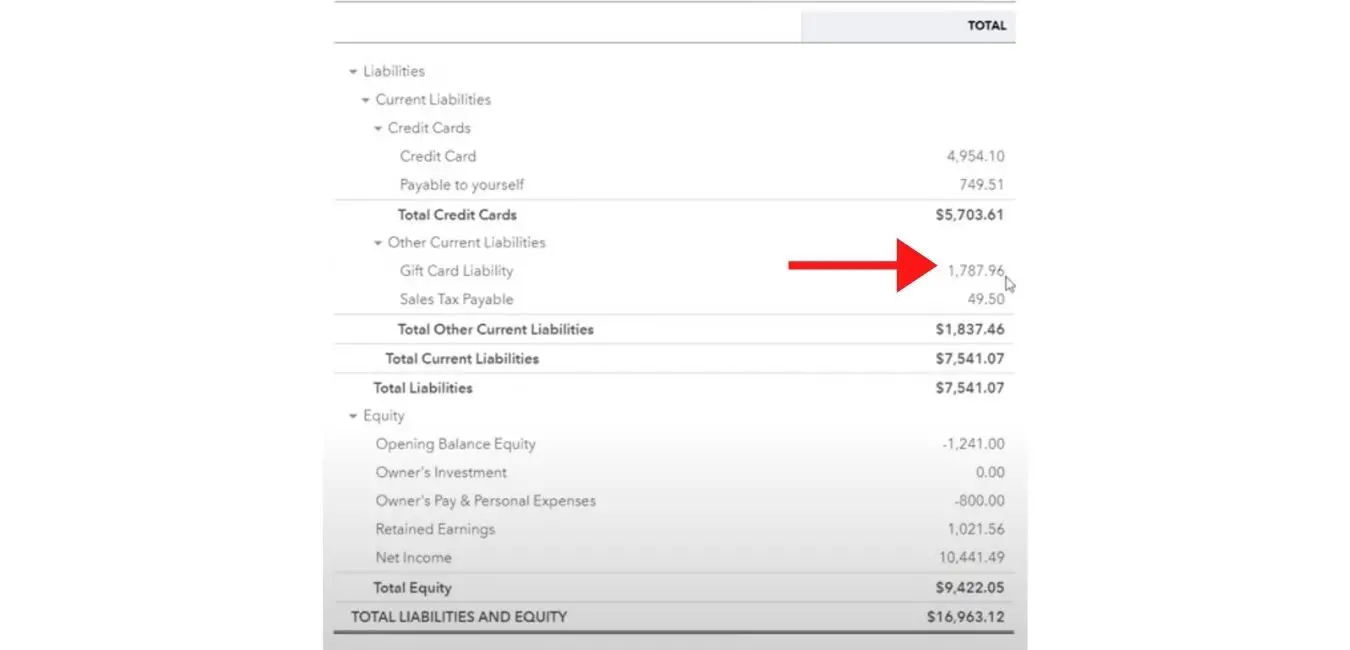

Once you’ve made the journal entry, the next step is to check your balance sheet as of the last day of the month. The Gift Card Liability account will show up there because it’s a liability. In order to check that your numbers are correct, compare the amount of the Gift Card Liability line in QuickBooks with the closing balance column on your spreadsheet. The two numbers should match.

Next Steps

The overall process of tracking Shopify gift cards is fairly simple once you’ve done this a few times. If you have questions, leave a comment on the video, and I’ll do my best to respond as quickly as possible.

For those of you who prefer to watch a video demonstration of this process, click here to watch it.