Are you wondering why the amount on your Etsy 1099 doesn’t match the numbers you have in QuickBooks Online and how to fix it? In this post, I’ll show you step-by-step how to tie out the profit and loss reports that you have in QuickBooks Online Simple Start to the 1099 you received from Etsy. (If you’d rather watch the video, click HERE.)

For every year that you have gross sales over $20k from your Etsy shop, you should receive a 1099. This amount will also be reported to the IRS. When you prepare your end of year financials, you may notice that the amount on your 1099 doesn’t quite match the amount you have in QuickBooks Online.

This post contains affiliate links. For more information, please see my disclosures.

(Before we begin, let me mention that the numbers I entered into QuickBooks Online were derived using my Etsy bookkeeping method. The calculations in this post presume that you have been following my method for doing your Etsy bookkeeping. If you haven’t, this process may not work for you. But if you have been following my method, you’re going to be in good shape. Click here to learn more about my method. Alternatively, you may have connected your QuickBooks Online Account to Etsy through the Sync with Etsy integration. That is also a great and accurate method of Etsy bookkeeping. Click here to learn more about Sync with Etsy.

Let’s take a look at two examples that I brought into our sample company. I’ve got Etsy shop example A, and I’ve got Etsy shop example B. Example A ties perfectly to the 1099 right away. Example B has a small difference, so we’ll cover how to resolve it.

When Your Etsy 1099 and Books Match

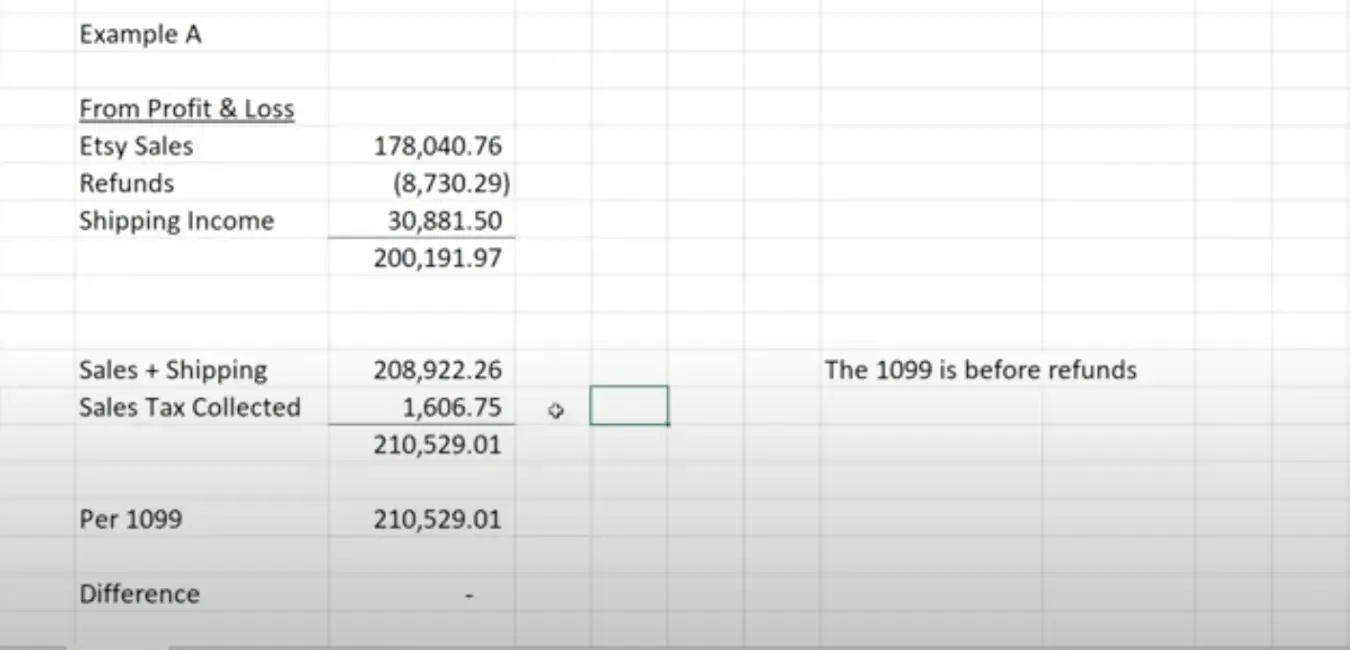

To find the amount for Example A, we’ll pull up the 1099 for example A. This can be found in Etsy under finances, legal and tax. Scrolling down to the bottom you can see that the amount is $210,529.01.

Let’s walk through how that ties out. According to example A’s profit and loss, we had Etsy sales, refunds, and shipping income that totaled $200,191.97. It’s important to note that the amount on the 1099 is before refunds. [You’ll still put the refunds on your schedule C, but you won’t be paying taxes on your refunds.] That’s why the number we’re going to use to tie out to the 1099 is just our sales and shipping numbers, which equals a total of $208,922.26

The next step is to add in any sales tax we have collected. For a lot of you, this number is going to be zero. Example A is from a Florida seller who does collect sales tax throughout the year from Florida residents. I went through all of the monthly journal entries that we did, and I added up all of the sales tax amounts that Etsy remitted to us throughout the year. The total was $1,606.75.

[If you’ve been following my method, you’ll know what I mean when I say I went through all the journal entries and found the sales tax number. If you haven’t been following my method, be sure to go back and watch those videos first.]

When you add the sales and shipping and sales tax numbers together, it totals $210,529.01. Remember that our Etsy 1099 amount was $210,529.01. This amount ties exactly to the 1099, which is such a good feeling. And if you’re handing off your profit and loss to your accountant, just show them this little breakdown that you did and tell them what numbers you added together to tie to the Etsy 1099.

When Your Etsy 1099 and Books Don’t Match

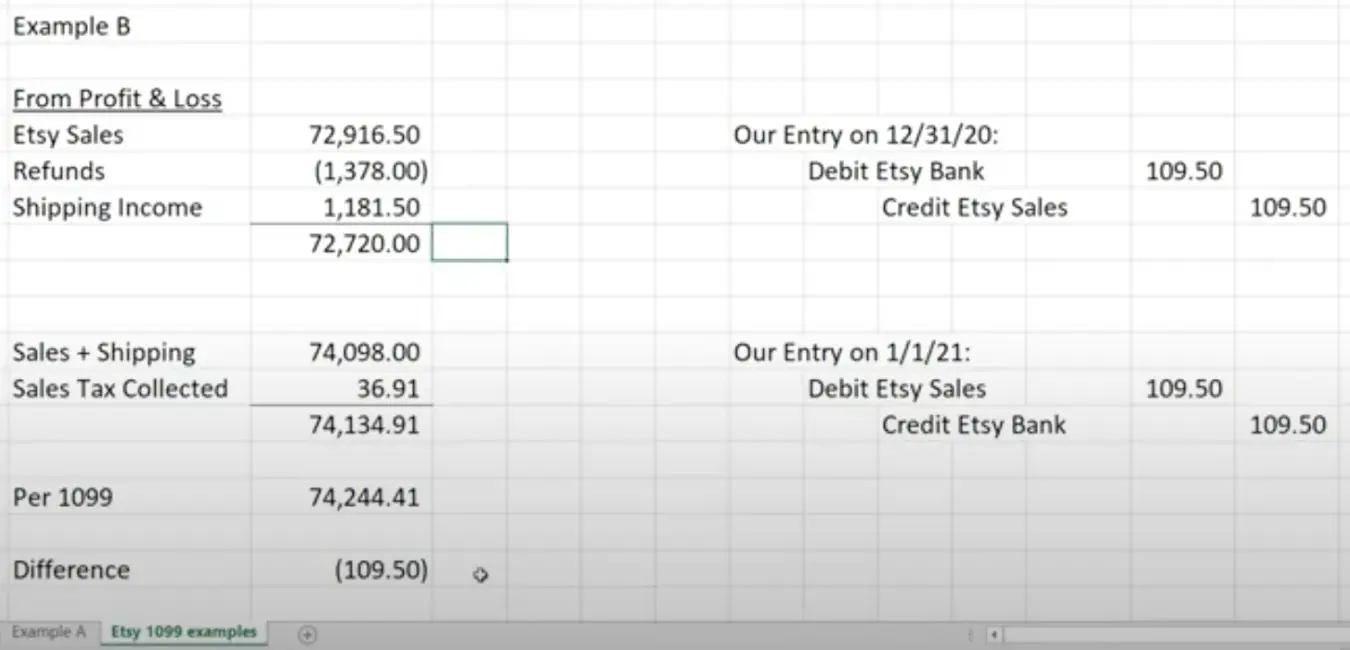

Let’s move on to example B, which has a little bit of a difference. If we look at our Profit and Loss report in QuickBooks Online Simple Start, we see Etsy sales of $72,916.50, refunds of $1,378.00, and shipping income of $1,181.50 for a grand total of $72,720.00. [We have also followed my method for recording income and fees throughout the year.]

When we add sales plus shipping, we get $74,098.00. As a reminder, we’re not including refunds because your 1099 number is before refunds. We also have $36.91 in sales tax collected from the beginning of the year when their state was switching over to a marketplace facilitator tax law, which brings the total to $74,134.91

The next step is to compare this amount $74,134.91 to the amount on the Etsy 1099. The amount on the Etsy 1099 is $74,244.41, which is a difference of $109.50. So, in the grand scheme of things, this difference is not a big deal, but let’s look at why we have a difference.

Etsy Reporting Differences

The simple answer is – the reason for this difference lies in a difference between Etsy reports. The numbers Etsy uses for the 1099 come from the Etsy payment sales CSV file for all of 2020. And you can find this report in Settings, Options, Download Data, select payment sales (but don’t select a month), and then select 2020.

[To more easily follow along with this next section, you may want to watch the video.] If we freeze the top row of this CSV file, and sum the gross amount column, the figure in that column agrees with the Etsy 1099. Now, if you look at this last sale on this report, you’ll notice that it was for $109.50. This was the last sale of the year, and the amount is our difference in tying to the 1099. So, if we look closely at the details, we notice the customer ordered the product on 12/31/2020, but the funds available date was 1/1/2021. That is why we have a difference.

If you’re familiar with my method for Etsy bookkeeping, you’ll know that we rely on the Etsy statement CSV file for bookkeeping purposes. This is also the report that the Sync with Etsy App uses. This report is found in your shop payment account. If you go to finances, payment account, that’s where you access your Etsy statement for the month, or the year. We must use the payment account statement reports for our bookkeeping throughout the year because it contains all the information that we need, including fees. We can’t use the payment sales report for our bookkeeping.

For our example, we downloaded the January 2021 statement from the shop payment account. That is where the $109.50 sale appears, which was made on December 31st, but it doesn’t get included in the shop payment account statement until January. So the two reports from Etsy are putting this transaction in different time periods. The payment sales report put this transaction in December 2020. The shop payment account statement put this transaction in January 2021. There is a timing difference between the two Etsy reports.

We used the Etsy payment account statement for December of 2020 when we did our Etsy end of the month entry for December of 2020. But that $109.50 wouldn’t have been there on the December report. It doesn’t show up until January of 2021.

Why Are There Two Different Reports?

So the question would be, when you do your Etsy entry every month, why aren’t you using the payment sales report, the one that the 1099 is derived from? Why aren’t we using this one for a monthly entry, if this is the one that agrees with the 1099?

The reason why we use the statement CSV file from the shop payment account every month, is so that we can tie to the ending Etsy balance per Etsy, and then the Etsy bank account in QuickBooks. You’ll know from my video that that’s an important step because it tells us whether we have done everything correctly.

If we were using a different report, we wouldn’t be able to tie to that ending Etsy balance, which is our cue that we have done everything correctly. So, that’s why we still continue to use the Etsy statement report. It also contains all the other information, like the fees that we need to record our Etsy information accurately in QuickBooks every month.

It’s not wrong to use the Etsy statement. We’re very right to use the Etsy statement, because it shows us our true cash picture. And that’s what we want represented in our bookkeeping. How do we fix it when we have a difference?

How To Adjust For The Reporting Difference

Instead of just leaving this difference for your tax preparer to worry about, we’re going to post a reversing entry in QuickBooks. Let’s walk through how to do this.

For our reversing entry, we’re going to post an entry on 12/31/2020, and then we’re going to reverse it on 1/1/21. The reason why we’re doing this, and the reason why we bother with reversing it is because we’re including this Etsy sale in 2020. If we don’t reverse it before we do our Etsy January 2021 entry, we would be including that $109.50 twice since it appears on the January statement, and we don’t want to mess up our Etsy bank balance at the end of January 2021.

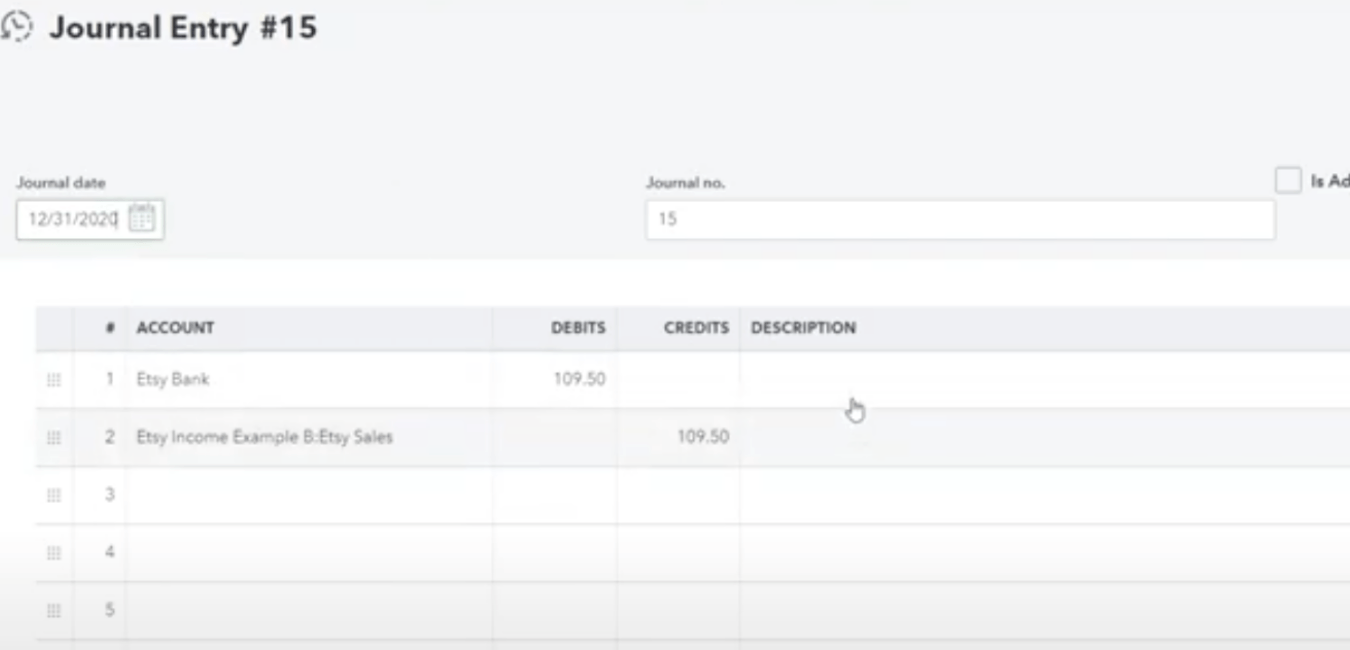

When we make the journal entry as of 12/31/20, we are going to debit Etsy bank $109.50 and credit Etsy sales the same amount. (See 12/31 journal entry in Example B image above and also in the image directly below.) Now when we look at our Profit & Loss report for example B, after the entry has been posted, the report shows $73,026 in Etsy sales. If we add the $73,026 plus our shipping income plus our sales tax collected, we get $74,244.41, which agrees with our Etsy 1099.

All that’s left is making the reverse journal entry in QuickBooks. You can simply find and duplicate the last entry you made, change the date to 1/1/2021, and reverse the accounts. (See example below, except I forgot to change the date to 1/1/21!) I’d also recommend adding a note that these are reversing entries to tie to your Etsy 1099.

More Etsy Bookkeeping Resources

I hope this post helped you tie your Etsy 1099 to QuickBooks. If you’re using my method, most of the time you are going to tie to the penny. The only time you’re likely to run into trouble is when you make sales on 12/31. These last minute purchases are going to cause you a very minor difference, but hopefully you understand how to adjust for these differences.

With this process, you can be confident that your numbers are good. You just had to deal with the timing difference between the two reports. All we’re doing is adjusting our profit and loss to account for that timing difference, so that everything is clear when we present our information to our tax preparer.

Even though this process is relatively simple, there are a lot of steps. If you would like to watch a video tutorial of this process, just click here. If you have any questions, leave them on the video, and I’ll do my best to answer them.